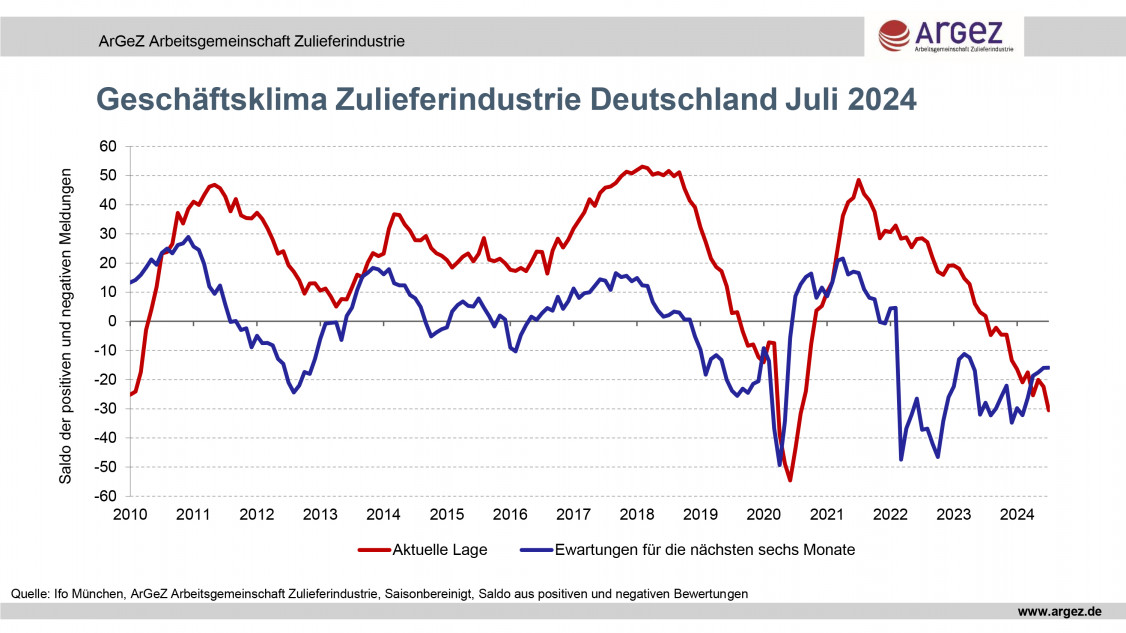

The seasonally adjusted ifo business climate of German suppliers deteriorated by 4.2 points to a value of -23.3, which is the lowest level since February. The decline in the business climate is therefore based exclusively on the poorer assessment of the current business situation. The balance fell by a significant 8.1 points and is now only -30.5 points. German suppliers last assessed their situation as worse in the summer of 2020. Only about one in seven companies in the supplier industry still rates the current business situation as ‘good’. A year ago, this figure was twice as high. At the same time, the proportion of those who rate the situation as neutral has also fallen. While around a quarter of German suppliers rated their current business as ‘poor’ last summer, the figure has now risen to over 42 per cent.

While many economists were still expecting an economic recovery to pick up as the year progressed at the beginning of the year, there is still little sign of this after the first half of the year.

It is also becoming increasingly clear to the German government that industrial production in Germany is at a crossroads. In view of some of the statements made by the government a few months ago, which drew the displeasure of the business community, the seriousness of the situation now seems to have been recognised. With the federal budget, the coalition leaders have now presented their so-called growth initiative. The aim of this is to increase the potential growth of the German economy by 0.5 percentage points. Although many of the 49 proposals are to be welcomed, it is doubtful whether they will have a major impact on industrial policy.

For the German supplier industry, this growth initiative is therefore no more than an urgently needed start to improving the framework conditions. The business climate index for the supplier industry is calculated by the supplier industry working group ArGeZ in cooperation with the Ifo Institute in Munich. It is based on a survey of around 600 companies and covers the sectors of the supply industry that are represented in the working group: the foundry industry, the aluminium industry, plastics processing, steel and metal processing, the non-ferrous metal industry, the rubber industry and technical textiles.

The chart, with corrected seasonally adjusted data, is available for download at www.argez.de.