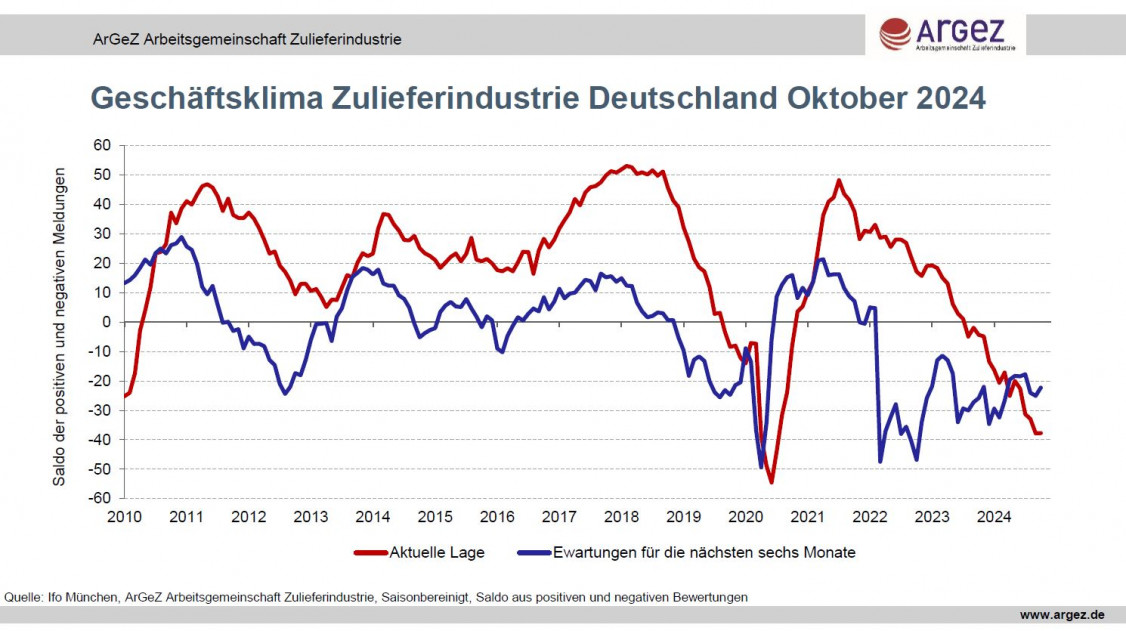

The seasonally adjusted ifo business climate for German suppliers rose again for the first time in five months. However, this is no reason for optimism. On the one hand, the increase was only 1.4 points, and on the other hand, the previous month marked the lowest point in the downward spiral that has now lasted for three years. The bottom line is that the October value is -30.2 points.

Although the balance of expectations for the next six months has recently risen slightly, it still remains deeply negative at 2.6 points. The vast majority of German suppliers expect business to remain the same or even get worse in the next six months. The calculated balance is -22.3 points. This is all the more problematic given that the assessment of the current business situation remains at the previous month's level of -37.7 balance points.

A further look at the companies' responses illustrates the seriousness of the situation: only 8 per cent of German suppliers report a “good” assessment of the situation. This value is approaching the historic low and marks the worst value in over 15 years! Meanwhile, only 6 per cent of suppliers expect ‘better’ business in the coming six months. Consequently, the report of improved expectations is based only on a smaller proportion of those who expect the situation to deteriorate further. However, this is not surprising given the already very poor assessment of the situation.

This very gloomy mood in the German supply industry should be seen as a warning signal that the transformation has finally failed. It comes at a time when negative headlines about the industry are becoming more frequent on an almost daily basis and the government can only be accused of being incapable of acting. The small and medium-sized suppliers will not be included in the chancellor's upcoming ‘industry summit’, nor can any impetus be expected from this summit or from the latest proposals of his ministers, who are in the midst of an election campaign and constantly bickering among themselves. This is all the more shocking given that the situation is increasingly becoming a fundamental turning point in German industrial and economic history. Comparable data that most closely describes the mood among suppliers can only be found during three phases in reunified Germany: in the early 1990s, during the global financial market crisis, and at the beginning of the coronavirus pandemic. Now, however, the outcome is more uncertain than ever. Despite the upcoming federal elections, German suppliers no longer have time for party-political games!

The business climate index for the supplier industry is determined by the supplier industry working group ArGeZ in cooperation with the Ifo Institute, Munich. It is based on a survey of around 600 companies and covers the sectors represented in the supplier industry working group: the foundry industry, the aluminium industry, plastics processing, steel and metal processing, the non-ferrous metal industry, the rubber industry and technical textiles.