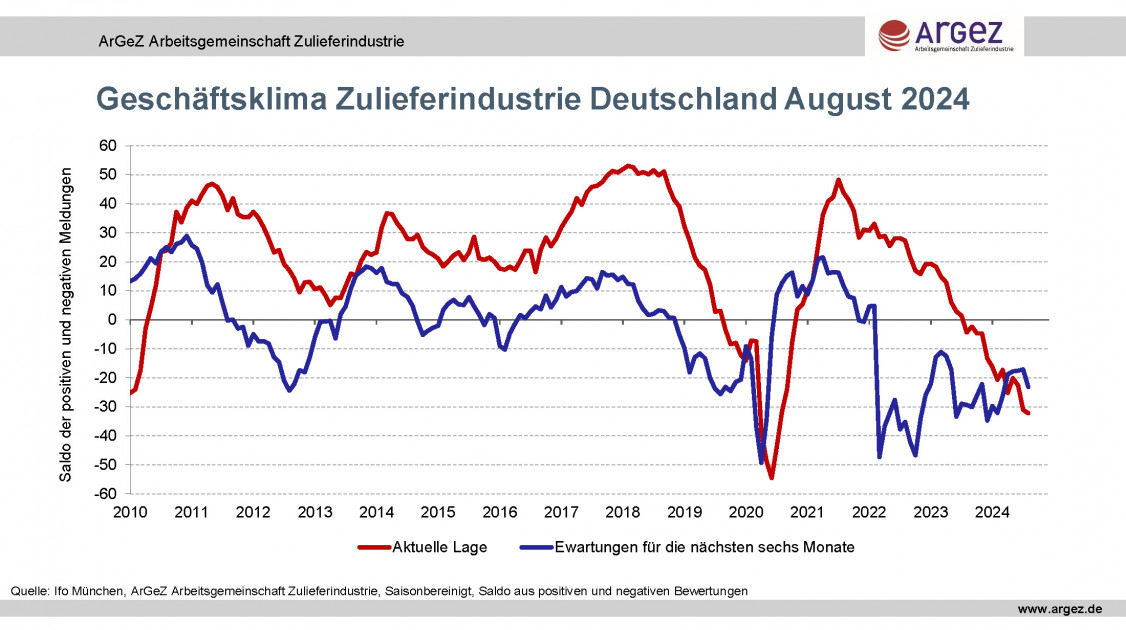

The seasonally adjusted ifo business climate for German suppliers deteriorated by 3.5 points to a value of -27.7 in August, its lowest level since the coronavirus summer of 2020.

The downward trend in the assessment of the current business situation continues. Contrary to the trend of recent months, however, the more than 500 companies that regularly provide their assessments are simultaneously reporting a setback in expectations for the next six months. These slump by 6.0 points in the seasonally adjusted balance and stand at -23.1 at the end of August.

Once again, the government chaos is likely to have caused uncertainty in recent months, in addition to the weak order situation. The repeated coalition-internal disputes over the federal budget no longer do justice to serious government work.

Meanwhile, hopes that the growth initiative announced last month will provide impetus are also fading. The concerns that the coalition will block itself with regard to the open points on the exact design are too great. Assuming that governments in normal times use measures to increase their chances of re-election, it can be seen that the election campaign is already in full swing within the coalition. Meanwhile, the damage being done to Germany as an industrial centre is increasing daily. However, it would be grossly negligent to simply hope that the economic downturn will soon come to an end. The macroeconomic indicators are now too negative for that.

The business climate index for the supplier industry is determined by the supplier industry working group ArGeZ in cooperation with the Ifo Institute, Munich. It is based on a survey of around 600 companies and covers the sectors united in the supplier industry working group: the foundry industry, aluminium industry, plastics processing, steel and metal processing, non-ferrous metal industry, rubber industry and technical textiles.